#1 Myth of branch cash management: Reducing Cash equals Optimal Cash Levels

While cash is central to banking operations, most financial institutions (FIs) carry too much of it (about 20-30% more than what they actually need) and unwittingly bear the direct and indirect costs of carrying excess cash. When banks and credit unions find out that they’re carrying too much, they often reduce their cash levels by a flat percentage across the board and assume that they’ve addressed the issue and solved the problem. However, simply reducing cash holdings by a flat percentage or dollar-amount does not give you optimal cash levels; banks and credit unions need to do more to optimize their cash holdings in a manner that drives up branch cash management efficiencies and increases branch profits.

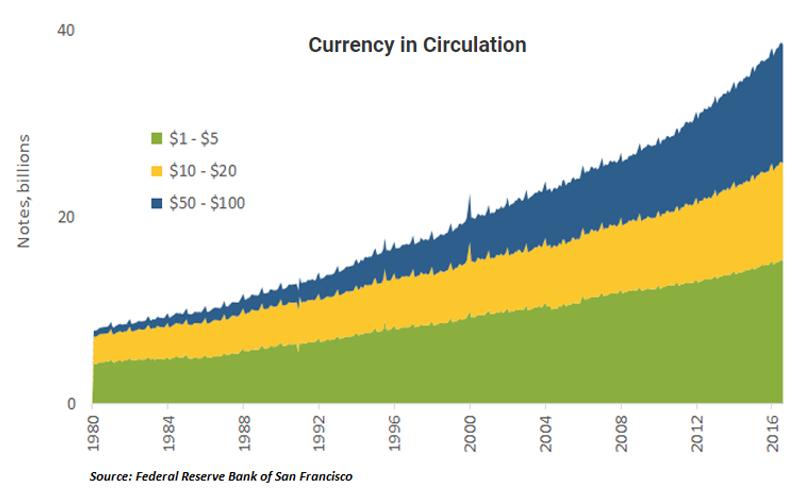

Cash Is Still the Most Frequently Used Consumer Payment InstrumentEven as non-cash, electronic and mobile payments grow in use, cash continues to be the most frequently used consumer payment instrument and dominates small-value transactions, according to a report by the Federal Reserve Bank of San Francisco. And for good reason – cash is convenient, it does not incur any transaction costs, it’s intuitive to use and it keeps consumers safe from hackers because there is no personal data or password involved when you simply pay with cash. Moreover, since the 2008 financial crisis, the amount of currency in circulation has steadily increased and demand for higher denominations has accelerated.

With more cash in circulation and with robust consumer demand for cash, banks and credit unions must ensure that they always carry adequate cash - in denominations needed by customers, while also avoiding the pitfall of carrying excess cash inventory that hurts the branch’s bottom line. To do so, FIs must monitor and manage the real-time inventory and usage of each cash denomination at every node - bank vaults, teller drawers, ATMs, cash recyclers, and other devices– because this is key to keeping optimal levels of cash at the branch.

Tracking Cash By-Denomination Is Key to Successful Cash Optimization

Tracking cash by denomination is helpful because excess cash is usually found at specific denominations. For example, a branch may only use $100,000 in $100 notes every week but might still carry $200,000 in $100 notes, resulting in $100,000 of excess $100s inventory. On the flip side, that same branch might run out of $10 bills once a month, so FIs can have overages and shortages at the same time.

So if the branch cuts cash by a flat 20-30% across the board, it would still end up with about 70% excess $100s’ inventory and would worsen its perennial shortage of $10s (and add to consumer dissatisfaction!)

Excess Cash Culprits and How to Fix Them

In a branch with poor branch cash management, excess cash is frequently found at multiple cash points.

Vaults: Find the Oldest Dated Strap of Cash

Consider doing this simple exercise to discover where your excess cash lies. Have each of your branch’s cash manager go into the vault and find the oldest dated strap of cash. This date, and the denomination the strap holds, will instantly give you an idea of how long your cash has been sitting in the vault and in which denomination.

ATMs: Don’t Fill ‘Em to Capacity

Excess cash is often found in branch ATMs, typically in $20 denominations. An ATM has a maximum amount of cash that you can put in it and a minimum amount that’s needed for the machine to function properly. When managing ATMs, most fill them to the maximum amount they can hold. However, if that machine only uses 60% of the maximum amount it can carry, it should not be filled to 100% of its capacity. So cutting back on the ATM fill is an easy point solution towards optimizing cash usage.

Recyclers: Stop Using Them as De Facto Vaults on Wheels

Recyclers also carry excess cash that’s relatively easy to optimize. Recyclers mostly sit behind the teller counter and make tellers more efficient by allowing them to drop cash in and withdraw cash quickly and easily. Sometimes, however, tellers default to using the recycler as their de facto personal vault. So you effectively have an improvised vault behind the counter (the recycler) in addition to the actual branch vault. While using the recycler as a vault starts benignly, it soon becomes too convenient to give up… so tellers stop replenishing cash from the vault and instead depend on the recycler. Subsequently, the person in-charge of ordering cash starts placing larger orders to include the original order for replenishment at the vault and the added amount needed for the recycler. Hence, recyclers offer another fairly straightforward opportunity to reduce excess cash by getting tellers to stop using the recycler as their personal vault.

Simple Percentage Reductions Fix Nothing and Could Exacerbate Problems

Optimization of cash starts with analyzing cash inventory and usage at all end-points. And, optimal cash levels aren’t a guaranteed flat cash reduction across the organization.

For instance, if a branch is plagued by constant outages of certain denominations, it may have to increase cash in those denominations. Alternately, if an ATM constantly experiences shortages, say, every weekend, the branch might need to add another ATM to cover demand at that location. Both of these items would optimize cash levels, but would equate to a cash increase for the institution.

Cash problems may also be the result of outdated cash limits that have not been reviewed for a year or more, but are still in use even though the branch has seen a significant change in cash outflow. Alternately, a branch may experience outages because cash limits were not set correctly to begin with, yet the branch cash levels are set to that inaccurate limit to adhere to management’s restrictions.

Sometimes, cash optimization could result in almost no net change in cash levels. For instance, if a branch was carrying the wrong denomination mix for its clientele (say more $20s and fewer $100s when serving small businesses that prefer $100s), simple adjustments in denominations could solve the problem while keeping total cash levels about the same.

Banks and credit unions should start their cash optimization process by addressing areas of cash ‘storage’ – vaults, ATMs, ITMs, recyclers and other devices – to get a feel of the extent of their cash problem, and go deeper – to usage by denomination - to optimize their cash levels to actual usage. And not resort to simplistic, flat reductions to optimize cash because that could only make their problems worse than before!

Learn how Marquette Savings Bank Took the Guesswork Out Of branch cash management

Sources: